Very short term it looks like we got room to move a little to the downside of a descending wedge and then we should break up and out of it. The target for the move down is about 88 and the target for the move up is about 90. After I expect it to continue down.

Longer term it looks like we are still with in a channel and have not bounced from the

uppertrend line. I don't know if wave 5 will go that deep (

GBT + Rob's count). But with the work

Schweizer did last week, I am inclined to believe this is a major interim top.

How do you like this...getting

xtrendish on this chart. Many people don't feel these really long term

trendlines hold up, but they do. Note where they all intersected recently in the green.

The 20ma has definitely curled over on the

BPSPX:

CPC. Again this marks an important interim top. Waiting on the 20 to cross the 50 for confirmation. Though I have started building my short position already.

Now this is interesting, during the rise this indicator has been optimistic. Normally it has been a

contrarian indicator especially in the short term. So I find it interesting that it is starting turn near the market top, could the indicator be in temporary alignment right now? I do expect that long term it is still a contrarian indicator.

Well with all the up and down today we managed to stay with in both the rising blue channel and the larger falling green channel. So which way now?

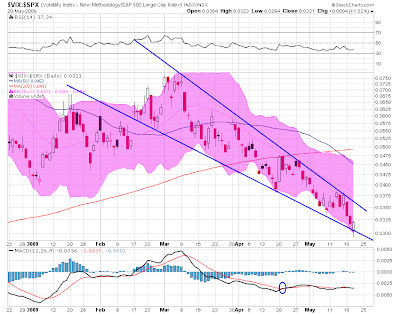

Well with all the up and down today we managed to stay with in both the rising blue channel and the larger falling green channel. So which way now? We did not break back in to the wedge on the VIX:SPX.

We did not break back in to the wedge on the VIX:SPX. CPCI:CPCE 30ma is about to cross the 50ma. This has been really bad. Note the previous times it has crossed.

CPCI:CPCE 30ma is about to cross the 50ma. This has been really bad. Note the previous times it has crossed.